Income protection, a personal protection policy in case you are left unable to work.

Income Protection Insurance pays out a regular tax-free monthly income to replace your income should you become unable to work because of accident or sickness.

If you suffer an injury or become ill during your working life, an Income Protection policy can help protect against any possible loss of income. It can help you keep up with your essential bills and other living costs until you’re able to return to work (subject to policy type taken).

The amount of income protection insurance you need will be determined by the salary that you want to insure. Generally, income protection provides cover for about 60% of your gross annual salary, however, you will not be taxed on any benefits that are paid out by the insurers.

Policies usually have a waiting period before they start paying out, which starts when you become unable to work. By choosing a longer period, the lower your premium. In order to choose an appropriate wating period you must find out what state benefits might be available and what your employer would pay you.

The premium you’ll pay will vary depending on your age, health and the level of income you wish to protect.

Getting actual advice is vital when taking out any protection policy. There are so many different things to consider, such as the type of policy you want, your budget, how much you want to leave behind plus your medical history.

We will carry out a full review of your circumstances, including any existing policies. We will then search the market for a policy designed to meet your needs within your budget and make a recommendation. We will then take care of everything for you, from the application to the underwriting and any medical reports if necessary

Like any insurance product, protection products won’t pay out if you didn’t disclose vital information when you initially made the application, or for fraud. Other than this, if the claim is for something covered under the policy conditions, it should pay out.

There is no set cost for this type of insurance as it’s based on your individual circumstances and needs. Things like your medical history, height and weight and smoker status get taken into consideration when insurers give you a quote.

If you want to run over some figures, see what options are available for you, or want to ask a few general questions, just enquire about a time below.

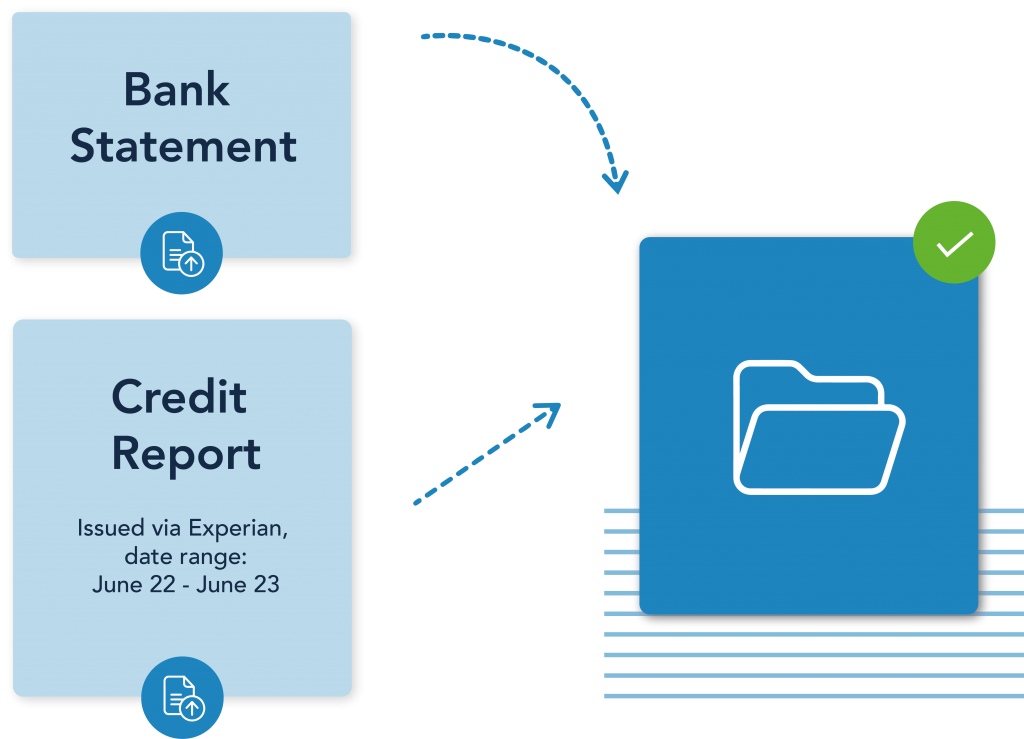

Register your account with Blue Stone, once approved, you can access your client portal.

Here you will be able to upload any and all documents that your broker requests and it will be received instantly on our end. With end-to-end encryption, this will save us both time and energy – letting us focus on the important things.